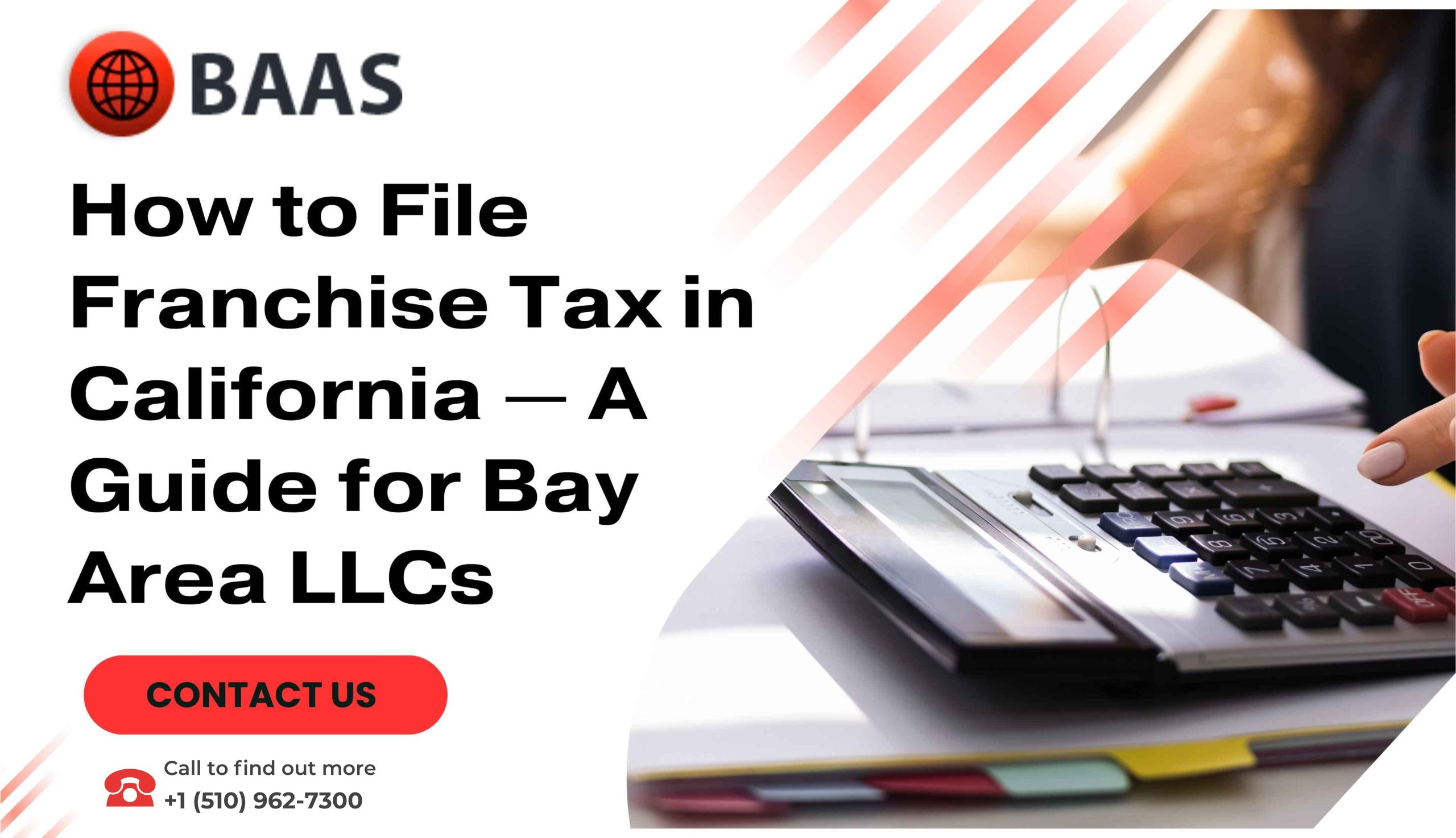

How to File Franchise Tax in California — A Guide for Bay Area LLCs

Launching an LLC in California, especially in the Bay Area, is an exciting step — but it also comes with important compliance responsibilities. One of the key requirements every LLC must handle is the California Franchise Tax, which applies annually regardless of profitability.

Many new business owners underestimate this obligation, leading to late filings, penalties, or even suspension of their LLC. Understanding how the Franchise Tax works — and filing it correctly — ensures your business remains compliant while you stay focused on growth.

This guide explains what the Franchise Tax is, who it applies to, filing deadlines, and how Bay Area LLCs can simplify compliance.

Why Bay Area LLCs Need to Pay Attention to Franchise Tax

The Bay Area is one of the most competitive business regions in the country, and staying compliant with California’s financial regulations is essential to avoid unnecessary setbacks. Unlike many states, California requires LLCs and other entities to pay an annual tax simply for the privilege of doing business here.

By filing on time and accurately, your LLC maintains good standing with the California Franchise Tax Board (FTB) and avoids interruptions that could affect banking, investor relations, or legal protections.

1. What is the California Franchise Tax?

The Franchise Tax is an annual fee required from most businesses registered in California, including LLCs, corporations, and partnerships. It applies whether or not the business earned income during the year.

Pro Tip: Treat the Franchise Tax as a recurring business expense — just like rent or utilities — to avoid surprises later.

2. Who Needs to File?

The Franchise Tax applies to most business entities operating in California, including:

- LLCs (Limited Liability Companies)

- Corporations (C-Corps and S-Corps)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

There are some exemptions for certain newly formed entities in their first year, but from the second year onward, the tax generally applies to all.

Pro Tip: Confirm your entity type and filing status early with a professional to determine your exact obligations.

3. Understanding Additional Fees

In addition to the standard annual franchise tax, some LLCs must also pay based on total gross receipts if they exceed certain thresholds. This ensures that larger businesses contribute more in proportion to their activity in California.

Pro Tip: Regular financial tracking throughout the year helps identify whether your business may be subject to additional fees well before the deadline.

4. Filing Deadlines Every Bay Area LLC Should Know

The Franchise Tax has specific due dates depending on your business structure and filing year. Missing these deadlines can result in penalties or even suspension of your business status.

Pro Tip: Mark your compliance calendar with reminders for Franchise Tax filings, along with other obligations like payroll taxes or sales tax, to avoid costly delays.

5. How to File the California Franchise Tax

LLCs typically need to file specific forms with the Franchise Tax Board, such as:

- Form 3522 (LLC Tax Voucher) for the annual tax

- Form 3536 (Estimated Fee) if gross receipts require an additional payment

- Form 568 (LLC Return of Income) as part of year-end reporting

Payments can be made online through the FTB’s Web Pay system or by mailing payment vouchers.

Pro Tip: Work with a professional bookkeeper or CPA to ensure accuracy. Misfilings or late submissions can be far more expensive to correct than doing it right the first time.

Why Bay Area LLCs Trust Local Professionals for Franchise Tax

- Local Expertise: Knowledge of California tax codes and Bay Area-specific compliance rules.

- Accurate Filings: Proper handling of all required forms and supporting documentation.

- Deadline Management: Ensuring no due dates are missed.

- Simplified Process: Allowing you to focus on business operations while experts handle compliance.

Why Bay Area Accounting Solutions (BAAS) is the Right Partner

At Bay Area Accounting Solutions, we specialize in helping LLCs across San Francisco, Oakland, San Jose, and surrounding areas stay compliant with California Franchise Tax requirements. Our services include:

- Franchise tax filing and compliance support

- LLC bookkeeping setup and clean-up

- Payroll and sales tax management

- Investor-ready financial reporting

- Cloud-based systems for real-time visibility

When you partner with BAAS, you gain a financial ally who ensures your LLC meets all requirements while freeing up your time to focus on growth.

Conclusion

Filing the California Franchise Tax is an unavoidable responsibility for Bay Area LLCs. Whether you’re in your first year or scaling rapidly, timely and accurate compliance protects your business from penalties and ensures smooth operations.

By working with local experts, you’ll have the confidence that your filings are handled correctly while you focus on what matters most: building and scaling your business.

👉 Ready to simplify your LLC’s tax compliance? Partner with Bay Area Accounting Solutions today and let us manage the filings while you grow your vision.

FAQ — California Franchise Tax for Bay Area LLCs

Q1: Do new LLCs have to pay in the first year?

Many new LLCs are exempt in their first tax year, but obligations begin in subsequent years.

Q2: What happens if my LLC misses the filing deadline?

The FTB can impose penalties, late fees, and even suspend your LLC’s status

Q3: Can I file and pay online?

Yes, the Franchise Tax Board provides an online payment system for convenience.

Q4: Are gross receipts fees the same as the franchise tax?

No. The franchise tax is the standard annual fee, while gross receipts fees apply only when business income exceeds certain levels.

Q5: Should I use a professional to file?

It’s strongly recommended. A professional ensures compliance, avoids errors, and saves time — especially in California’s complex tax environment.